Contemplating the prospect of purchasing a home this year likely has you closely monitoring the housing market through various channels – be it the news, social media, consultations with your real estate agent, or discussions with friends and family.

Amidst the wealth of information, the recurrent themes are probably home prices and mortgage rates. To aid in your decision-making process, consider the following two pivotal questions and the accompanying data that cuts through the market noise.

Where Do I Anticipate Home Prices Are Heading?

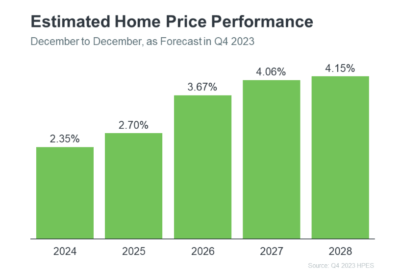

For reliable insights into home price forecasts, turn your attention to the Home Price Expectations Survey by Fannie Mae. This survey compiles data from over a hundred economists, real estate experts, and investment and market strategists.

The latest release indicates a consensus among experts that home prices will likely continue to rise, extending at least through 2028 (refer to the accompanying graph). While the percentage of appreciation may not match recent years’ highs, the crucial point is that the survey predicts a sustained upward trajectory for the next five years.

Despite a potentially more moderate pace, rising home prices are positive news, not just for the market but for you. Purchasing now could result in your home appreciating in value, leading to gained home equity in the coming years. Waiting, as per these forecasts, might mean a higher cost for the same home later on.

Where Do I Envisage Mortgage Rates Are Heading?

Over the past year, mortgage rates experienced spikes due to economic uncertainty and inflation. However, a positive development for the market and mortgage rates is the moderation of inflation.

When inflation cools, mortgage rates often respond with a decline, a trend evident in recent weeks. Additionally, with the Federal Reserve signaling a pause in their Federal Funds Rate increases and potential rate cuts in 2024, experts express confidence in a downward trajectory for mortgage rates.

Realtor.com’s Chief Economist, Danielle Hale, anticipates that mortgage rates will continue to ease in 2024, attributing this to improvements in inflation and the proximity of potential Fed rate cuts. The National Association of Realtors echoes this sentiment, stating that mortgage rates likely peaked and are now on a downward trend from their recent high of nearly 8%. This trend is expected to enhance housing affordability, enticing more home buyers back into the market.

While absolute certainty about future mortgage rates is elusive, recent declines and the Federal Reserve’s decision signal hope for a positive trajectory. Although some volatility may persist, improving affordability is anticipated as rates continue to ease.

For those contemplating a home purchase, staying informed about expected home prices and mortgage rates is crucial. While certainty remains elusive, keeping abreast of the latest information can empower you to make informed decisions.

Let’s connect so you can stay updated on market dynamics and understand why this news is particularly favorable for you.

[noptin-form id=14460]